Project Overview

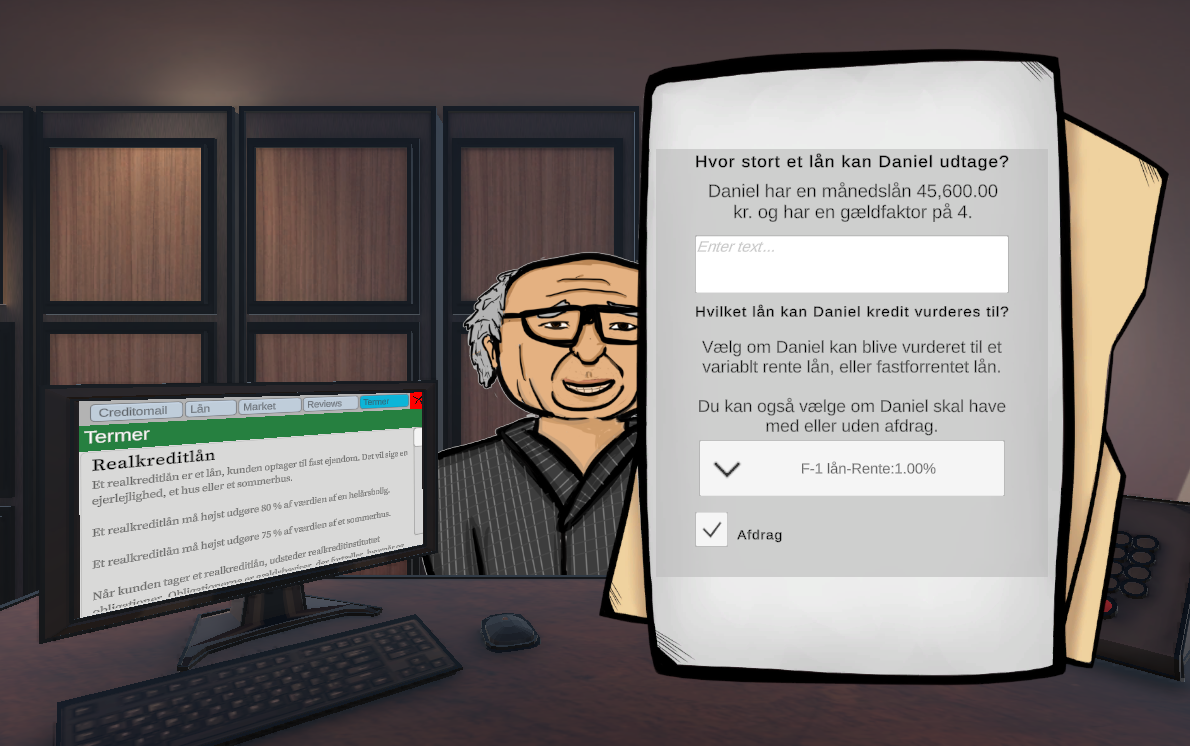

A lecturer at Copenhagen Business Academy had expressed a need for a tool to help her stutents understand mortgate loans and bonds. As she was teaching future financial advisors, we decided to make a serious game, that puts the student in the role of a financial advisor. Clients would come in with different needs and the student would have to recommend the right type of mortgate. The financial market also changes over time, requring the student to always make an informed decision based on the current market.

In the development of the game, we used Unity and C# to create. I was in charge of the system architecture. A big prioity was to make the game easy to scale, both in regard to adding new clients and cases, but also new potential features. To keep the codebase manageble, I used the Object Oriented Programming patteren

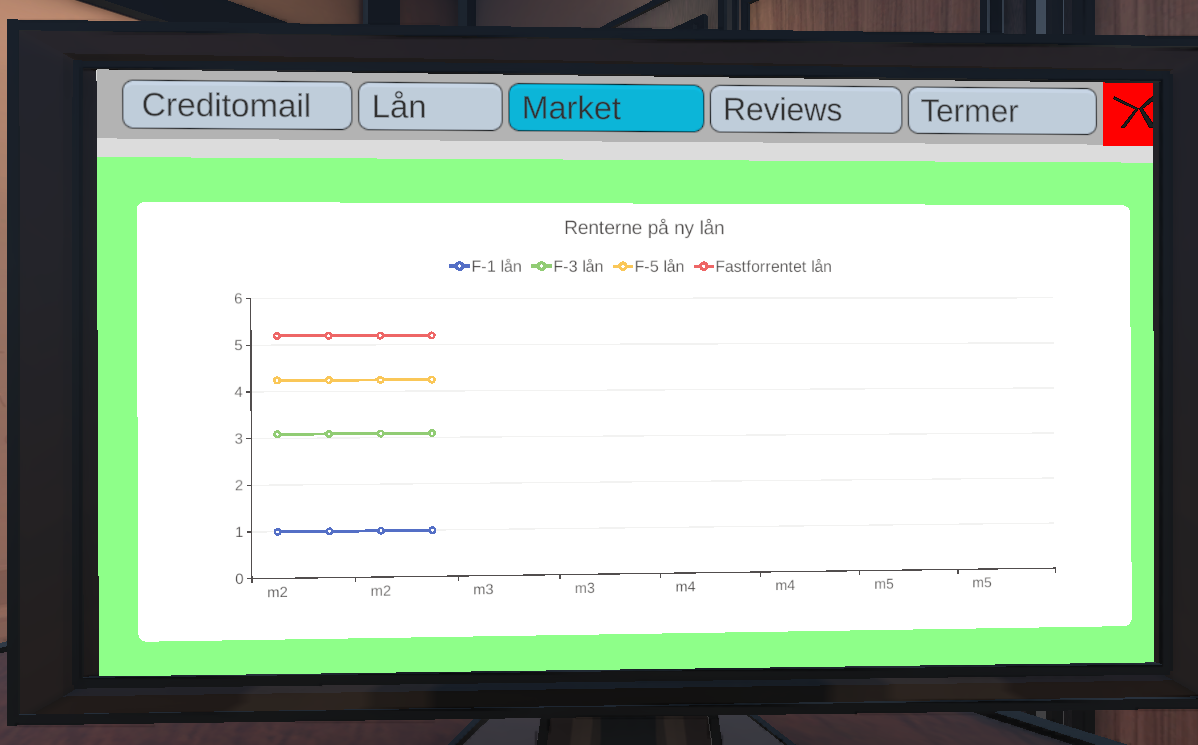

Aditionally, I implemented a big part of the economics simulation used in the game. To simulate variable loans and the financial market, the Hull-White model was used (Hull and White, 1996, “Using Hull-White Interest Rate Trees.”). We chose to simulate these aspects, as the stakeholder wanted the game to be reusable for the future and not stuck in the current financial market.